FBOs Power India’s Business Aviation Growth

- India’s growing business aviation sector is increasing the demand for Fixed-Base Operators (FBOs) to support expansion.

- FBOs provide essential infrastructure for private jet users, enabling faster operations in India.

- By offering a premium experience, FBOs enhance the appeal of private aviation in India’s growing market.

With the growth of business aviation in the country, there is a need for a growing number of Fixed-Base Operators (FBO), which are essentially a private terminal located inside an airport and caters to all the needs of private aircraft owners/operators and passengers. An FBO is a private facility within an airport that cater to the needs of private fliers and is separated from commercial aircraft terminals. In fact, FBOs are critical for a seamless private aircraft experience and are key to the growth of the business aviation market in India.

An FBO promises a faster turnaround of business jets and chartered planes as they no longer have to compete for taxi slots with the commercial airlines at an airport. While FBO infrastructure is expensive to create, maintain and operate, it can aid in driving further growth of private and general aviation in the country by growing connectivity, specialised tourism travel, aiding businesses with industrial trips, facilitating medical evacuations, etc.

As per the U.S. National Business Aviation Association (NBAA), there are about 3,000 fixed-base operators providing services to the business aviation industry at airports nationwide in the USA. Importantly, according to the NBAA, Business aviation is an essential tool to companies and organisations of all kinds and sizes, including universities, non-profits, hospitals and farms. Firefighters, law enforcement and government agencies use these aircraft every day. Only 3% of U.S. business aircraft are flown by Fortune 500 companies. The NBAA goes on to add that almost half of business aviation missions are to destinations with infrequent or no scheduled airline services, while more than a third are to destinations that have never had commercial air services.

First FBO

India’s first FBO only became operational as recently as October 2020 when GMR led Delhi Airport launched India’s first exclusive General Aviation terminal facility for private jets. Considered as one-of-its-kind project successfully completed by GMR Airports, the terminal was built to support the movement and processing of chartered flight passengers. There are two FBO and Maintenance Repair and Overhaul (MRO) operators catering to Business and General Aviation flights in MJets Indamer and Bird ExecuJet.

The terminal has the capacity to cater to 150 Private Jet movements on a daily basis, including Code C-type aircraft. These are 50-seater charter aircraft which are the biggest in their category. Over 50 passengers can be handled every hour and the GA Terminal and the newly developed General Aviation Aircraft Parking stands are co-located, providing passengers with a shorter distance to travel before boarding or de-boarding. The developed aircraft apron is spread over an 8 lakh sq ft area with dedicated parking bays for 57 General Aviation aircraft.

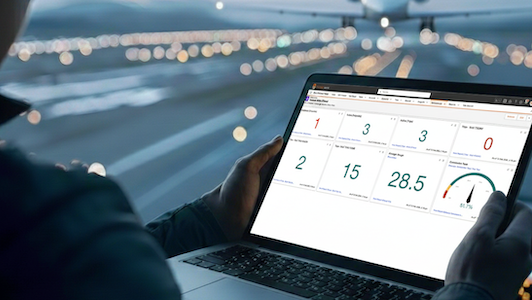

The Delhi Airport General Aviation terminal facility offers a range of passenger facilities like spacious lounges, retail and F&B sections, 24×7 personal concierge services, a common processing area with Customs and Immigration and immediate access to private jet aircraft stands from the Terminal. An access control system, Wi-Fi enabled services, IT system integrated with overall Delhi Airport’s platform, perimeter security control system, etc. are also provided. Facilities for crew members and staff, such as restroom and briefing area, are also available in this new Terminal.

Sizeable Market

According to the market research firm Imarc, the size of India’s business jet market size reached USD 650.5 Million in 2024. Looking forward, IMARC Group stated that it expected the market to grow to USD 1,139.9 Million by 2033, exhibiting a growth rate (CAGR) of 6.43% during 2025-2033. “The increasing demand for business jets, which offer time-saving advantages over commercial flights, thereby enabling executives to travel directly to their destinations without the hassle of lengthy airport procedures and layovers, is driving the market,” Imarc stated in a forecast.

As per the ‘Asia Pacific FBO Market Report 2025’ released by Cognitive Market Research, “the global Fixed base Operators – FBO market size was estimated at USD 26512.2 million out of which Asia Pacific held the market of around 23 % of the global revenue with a market size of USD 6097.81 million in 2024 and will grow at a compound annual growth rate (CAGR) of 8.0 % from 2024 to 2031.” The report forecast that India’s FBO market was worth USD 731.74 million in 2024, is projected to grow at a CAGR of 9.8% during the forecast period. “The demand is augmented by India’s increasing rapid economic growth leading to increased business aviation.”

The report when on to add that the Asia Pacific region’s expanding aviation sector and rising wealth are driving a rapid market rise for FBOs. “Demand for private and corporate aviation services is increasing as the number of affluent individuals and organisations rises. The rise in corporate jet ownership and luxury travel is one market factor propelling this boom. The FBO industry is positioned for significant expansion as Asia Pacific emerges as a global economic powerhouse, offering operators the opportunity to establish a foothold in this dynamic and fast expanding aviation landscape.”

As per IIFL Capital, India’s private business jet fleet stands at more than 150 planes having grown at a rate of 0.5% annually from 2011 to 2020. “Of these, half are said to be big jets like the Falcon 900XP, while 30% are mid-size jets like Hawker 900XP and the rest are light jets like Citation M2,” the firm said. However as per market industry estimates, India’s business jet fleet grew by 7% in 2022. In a February 2024 article by Sari Sawaya, Sales Director at Jetstream, he stated that India was the busiest Asian market for business jet activity, with WingX data showing movements in 2023 are up 21% compared to 2022. “At Jetcraft, we’ve seen rising demand from prospective buyers in India, with midsize and large aircraft types the most popular. There are still challenges to overcome in the country, but with the right investment in infrastructure and a new approach to regulation, India is poised to become a new growth engine for aviation,” he said.

Time for Growth

Business and private aviation growth has lagged in India, despite the obvious potential of a large market and fast growing economy. While in the past, the case for an FBO was difficult to make due to bureaucratic red tape and a high cost structure for private and business aviation; the situation is changing today. The emergence of Urban Air Mobility (UAM) platforms and their future need for operating bases, could also ensure improved operating viability for FBOs. There is also the fact that India’s business, private and charter aviation markets are largely untapped and are only expected to grow in the coming years. On the back of such a positive outlook, it is clear that FBOs will become increasingly widespread in the years to come.