Lower Leasing Costs, Greater Investor Trust: India’s Aircraft Objects Act Explained

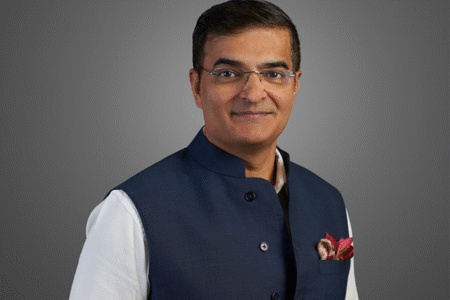

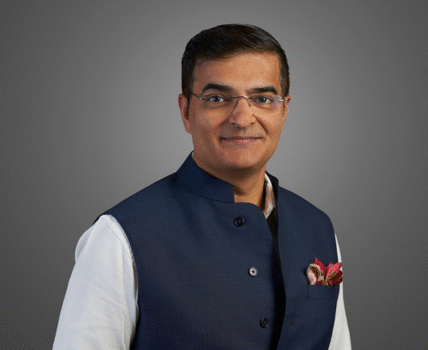

India’s aviation industry is poised for a significant transformation with the implementation of the Protection of Interests in Aircraft Objects Bill, 2025. Passed in April, this landmark legislation integrates the Cape Town Convention into Indian law, addressing critical gaps in aircraft leasing and financing. Nitin Sarin, Managing Partner at Sarin & Co., highlights in this conversation with Nidhi Sharma that the success of this reform depends on clarity, consistency, and efficient implementation. This is a defining moment for India to establish itself as a global aviation financing hub.

The Protection of Interests in Aircraft Objects Bill, 2025, implements the Cape Town Convention and Aircraft Protocol as domestic law. How would you assess its immediate impact on aligning India with international aviation leasing norms?

The immediate impact has already been very positive. To understand its significance, we must consider the timeline. India acceded to the Cape Town Convention back in 2008, but at the time, it was felt that no specific enabling legislation was necessary. However, experience has shown that when there is a conflict between Indian domestic law enacted by Parliament and international conventions, Indian courts have consistently ruled in favour of domestic law.

Over the years, high-profile airline bankruptcies like Kingfisher and others exposed this gap. Ministries would often step in to manage these situations, attempting ad hoc solutions. But it became clear that more substantial legal reform was necessary, especially as India continued to attract significant investment from the international aviation finance community, with major carriers like IndiGo benefiting from that inflow.

Although discussions and draft frameworks were ongoing, no concrete legislation materialised for years. The government had been proactive in streamlining aircraft deregistration, but export procedures remained problematic. Our customs laws did not anticipate scenarios where the importer of an aircraft wasn’t also its exporter.

It was the GoFirst insolvency that finally triggered a collective response. Lessors and financiers were unable to repossess their aircraft for over a year, a situation that sent shockwaves through the aviation finance industry. Despite the airline voluntarily filing for bankruptcy, the legal system failed to protect the rights of aircraft owners, exposing deep flaws in the system. This case became a turning point.

The government’s subsequent move to introduce the Protection of Interests in Aircraft Objects Bill wasn’t merely to align domestic law with international commitments. It was to restore confidence among global financiers, who are critical to India’s aviation ecosystem. These financiers provide the backbone for carriers like IndiGo and Air India, which rely heavily on affordable leasing.

This legislation acts as a much-needed safeguard, reassuring financiers, offering legal clarity, and ultimately reducing the cost of capital for Indian airlines. In doing so, it helps stabilise and strengthen the entire aviation sector.

How critical is the DGCA’s new role as Registry Authority in ensuring reliable asset registration and enforcement?

That doesn’t really change anything substantial. It was expected all along, and those aspects continue as they are. However, what’s truly significant in the new framework is the enhanced role of the DGCA. If you look closely at some of the provisions, the DGCA is now empowered to collect and maintain records of all dues associated with an aircraft.

Currently, suppose I need to export an aircraft from India, say, in a situation where the operator has gone bankrupt, disappeared overnight, or is acting in bad faith and refuses to cooperate. In that case, I am forced to run from pillar to post. I have to approach multiple agencies, including the Airports Authority of India (AAI), fuel suppliers, and others, just to determine how much is owed against that aircraft. It’s a disjointed and inefficient process.

What this Bill aims to do is address that bottleneck. Moving forward, the responsibility will lie with the airline or operator to file all such financial information with the DGCA, which will serve as the designated registry authority. While the specifics will be outlined in upcoming rules, the idea is clear: stakeholders will no longer have to chase various entities for information. Instead, they can simply approach one centralised authority for all outstanding dues.

This will hopefully eliminate the common scenario where an unknown creditor appears at the last minute to block an aircraft’s export, turning what should be a routine process into a prolonged and frustrating ordeal. With this centralisation, the process is expected to become more transparent, streamlined, and predictable.

One objective is reducing financing costs, currently 8–10 per cent higher due to legal uncertainty. In your experience, how quickly can we expect to see lower aircraft leasing rates?

The impact has already begun, in the sense that stakeholders are actively seeking information and starting to engage with the new framework. We are currently witnessing a dual reality in India’s aviation landscape. On one end, we have established carriers like IndiGo and Air India, which enjoy strong creditworthiness and relatively easy access to financing. On the other hand, we have airlines like SpiceJet, Akasa, and newer startups, whose credit profiles raise concerns among lessors and financiers.

Understandably, there’s growing caution in the market, many are asking tough questions and scrutinising the risk profiles of these smaller or newer operators. However, these are precisely the players who stand to gain the most from the implementation of the new Bill.

Initiatives like the Regional Connectivity Scheme will likely receive a significant boost, as smaller airlines aiming to operate fleets of 4–5 aircraft may now find it easier to lease planes. Until now, these carriers have struggled to secure aircraft, often facing reluctance from lessors unwilling to lease without substantial security deposits. With the new protections in place, confidence in leasing to such operators should improve, making it more feasible for them to acquire aircraft and expand regional connectivity.

With investors eyeing Indian carriers, how much will the Bill boost confidence among JOLCO, EETC, and lessors, especially via GIFT City?

For lessors, this legislation is a fundamental requirement, essentially a box that must be checked. That’s stage one, and in many ways, it means half the battle is already won. However, the real test lies in how the law is applied in practice. We will only know it’s true effectiveness when it’s tested during a future insolvency, and given the volatile nature of the aviation industry, that’s inevitable.

What’s critical now is ensuring the system is robust, coordinated, and that all stakeholders are aligned. One of the recurring challenges in India is the tendency for multiple interpretations to emerge, leading to confusion and indecision. Too many authorities get involved, and as the saying goes, too many cooks spoil the broth. With no one taking clear responsibility, the matter often ends up in court, which is far from ideal, especially considering how lengthy and uncertain litigation can be.

For this framework to succeed, we need clarity, consistency, and the will to implement it efficiently, without relying on judicial intervention as the default resolution mechanism.

The Bill gives creditors rights to repossess aircraft within two months of default. How does this remedy address challenges seen in cases like GoFirst?

The provision essentially states that in the event of an insolvency, let’s take, for example, the admission of an IBC petition against GoFirst, if Alternative A is invoked, as we believe it was, then a specific timeline comes into play. Although there was previously no domestic legislation in the country, Alternative A outlines that the resolution professional appointed under the Insolvency and Bankruptcy Code (IBC) is permitted to retain possession of the aircraft for a period of 60 days.

However, this grace period is conditional on two key factors.

First, two months of aircraft lease rental still has to be paid. Second, the aircraft must be preserved in proper condition during this time. Once the 60 day period lapses, and assuming these conditions have been met, the lessor is entitled to repossess the aircraft immediately on the 61st day.

The intent behind this provision is to provide a limited breathing space for the resolution professional, to assess the situation, explore revival strategies, and potentially rescue the airline. It’s a practical compromise, balancing the rights of lessors with the broader goal of giving struggling airlines a brief window to attempt recovery.

The Bill overrides conflicting domestic laws like the IBC and locates jurisdiction with the High Courts. Do you foresee any legal friction or need for clarification during implementation?

That’s true, but it’s important to understand that the jurisdiction of the High Court under this framework is not all-encompassing. It applies specifically in the context of Article 53 of the Cape Town Convention, which pertains to the preservation and possession of aircraft assets. While the scope is not extremely narrow, it doesn’t allow someone to bypass all other legal procedures and approach the High Court directly for any and every matter.

At this stage, there is still a significant need for clarification. The current Bill is what one might call “short-form legislation”; it establishes the framework but leaves nearly 90 per cent of the operational and procedural details to subordinate legislation, including rules and regulations that are yet to be issued. The Ministry of Civil Aviation, in collaboration with us, the Aviation Working Group, the Airports Authority of India, and other relevant bodies, are actively working on developing those regulations.

This pending framework will be critical in determining how the law functions in practice. I also believe that, inevitably, a case will arise that tests the application of this law in court. That will be our opportunity to demonstrate to the global aviation community that India respects the rule of law and is committed to honouring its international obligations. Whether or not it plays out that way remains to be seen.

The Bill also permits detention by government authorities. How should operators and financiers navigate these concurrent rights?

The Cape Town Convention already permits the payment of all government dues, and this aligns closely with the earlier point I mentioned, where the operator is required to regularly file details of outstanding dues with the DGCA. What the industry has now proposed to the government is that this reporting should happen on a monthly basis and be made publicly accessible.

This way, if an aircraft is leased to an airline and that airline has failed to clear its government dues for, say, two months, the lessor can intervene and take back the aircraft before the situation escalates. It introduces a form of self-governance and real-time financial monitoring, helping lessors mitigate risk proactively.

Without such a transparent mechanism in place, the government unquestionably retains the power to detain, attach, or prevent the export of an aircraft over unpaid dues. The aim is to prevent reaching that stage by empowering all parties to monitor compliance in a timely and structured manner.

What remaining policy or tax reforms, such as SPV clarity or EPR-like lifecycle obligations, are essential to complement this Bill and further transform India into an aviation financing hub?

At the moment, we are treading on very dangerous ground. The government has issued notices to all aircraft lessors with leases into India, a move that carries serious risks. It would take just one misguided decision from a single official to determine that a lessor is liable for taxation in India, and the repercussions could be catastrophic for the entire aviation leasing ecosystem.

Such a precedent could undermine the very foundation of our industry. This is a critical issue that demands urgent attention. We must resolve it decisively, reaffirm our commitment to the India-Ireland Double Taxation Avoidance Agreement and stop casting doubt on it. Prolonging uncertainty will only damage our credibility and jeopardise future investments in Indian aviation.

How will this legal reform shape opportunities for emerging airlines and regional operators?

Absolutely. As things stand today, even if you and I were to approach the market with a billion dollars in cash and a solid business plan to launch an airline, lessors would still hesitate to provide us with an aircraft, simply because of the prevailing legal uncertainties.

The one condition on which the lessors might agree is that if the aircraft is purchased outright, and this will not be a feasible option for most startups.

Startups typically lack the capital required for such heavy upfront investments. That’s precisely why leasing exists, to enable new and smaller players to enter the market without bearing the full cost of ownership. So yes, this legislation will be a game-changer, particularly for emerging airlines and startups. They stand to gain far more from the protections and clarity this Bill offers than the larger, more established carriers like IndiGo or Air India.

As a recognised expert in aircraft finance and Cape Town law, how does this transformation reflect India’s evolution in aviation law?

We have been adaptive and responsive to change over time. Could the pace have been faster. Absolutely! but that’s often the reality of how our system operates. That said, I believe we are now on the right path and poised to make meaningful progress. Going forward, our primary focus must be on infrastructure and, critically, on safety.

The recent Air India incident has highlighted the urgent need to prioritise safety across the board and it is not just about isolated accidents. We need a systemic, long-term commitment to enhancing safety standards.

At the same time, infrastructure demands immediate attention. Our major hubs, like Delhi and Mumbai, are rapidly approaching saturation. If we don’t act now, we will soon find ourselves in a position where the system is overwhelmed, and we are left scrambling for solutions. Proactive planning and investment are essential to avoid that scenario.

Given your experience, training professionals and advising international banks, what practical challenges and opportunities do you anticipate during the rollout of this Act?

The first practical challenge lies in the potential for misinterpretation by various arms of the government. It wouldn’t be surprising if some official, sitting in a different department, applies a completely bizarre interpretation of a provision. And to be clear, I am not referring to the Ministry of Civil Aviation, they have been extremely proactive. However, our system doesn’t function in silos. Implementation will require alignment and support from other key ministries, such as Finance and Home Affairs, which could pose complications.

The second major challenge is judicial. If any clause of the legislation is ever tested in a court of law, the resolution process is likely to be slow. Unfortunately, delays in the judicial system are well known, and that could create prolonged uncertainty.

These, in my view, are the two most significant hurdles we’re likely to face at this stage.

Read More: AIESL Secures Dual EASA Approvals, Advancing India’s MRO Hub Ambitions